Trading psychology

I published this article in January 2009 on my Czech website Chrtba.com, but I believe this topic is always important for any trader.

The truth is that the psychology affects your success in trading hugely.

Some people say that successful and profitable trading is composed of 70% psychology, 20% money management and only 10% of your strategy. I do believe them because on my trading journey it was mainly the psychology which affected my results most.

I want to say that the article is my personal point of view and I am not psychologist, I am not a writer, I just want to share with you my experience. I am currently trading during the writing the article, so I can gradually describe my feelings in the article.

Feeling description

I have traded four horse races, first two have finished with a loss 14 and 7 €, I was even thinking how calmly I’ve accepted them. Maybe it is because I have some responsibility today – I write an article about psychology, so I am focused to do things right. It means keep the calm head after any loss.

Then I have traded next two races with completely clean head and what happened – a profit of 12€ and 6€. So everything is OK, wait a minute, I will trade another horse race and I will start writing again…

Another loss, minus 19€, I am getting little bit hot blooded, because the loss was caused only by my stupidity. I know absolutely exactly where I made mistakes – first, I have entered the market because I was feeling bored, so that was a loss of 14€. OK, I have accepted that, it was just my dementia. Then I did get calm, I was doing nothing and I said to myself that I will “soak up the atmosphere”. At the end of the race, the market reached a level of 2.50, which was very strong support as it was not below ever before. There was a huge Weight of money on the Back side, so I was prepared to wait once this support level is broken and take the profit if the market goes down. And really, the level was broken, market went down and my loss was only 7€. But then, I made another mistake – the market was continuing in downtrend (and it was only last few seconds till the end) and I wanted to make this race even better. So, without any signal, I have Backed. Of course it didn’t pay off, so my final loss in this market was mentioned 19€.

My feelings after the race were quite calm. Although I had a loss of 19€, I knew it was not because of the “wrong moving” market, or a slow internet connection. I knew that I lost those 19€ because of my own mistakes. If I didn’t place a bet because I was bored and if I didn’t make a trade without any signal then I would be 10€ in profit. The error is not in the system – THE ERROR IS INSIDE ME…

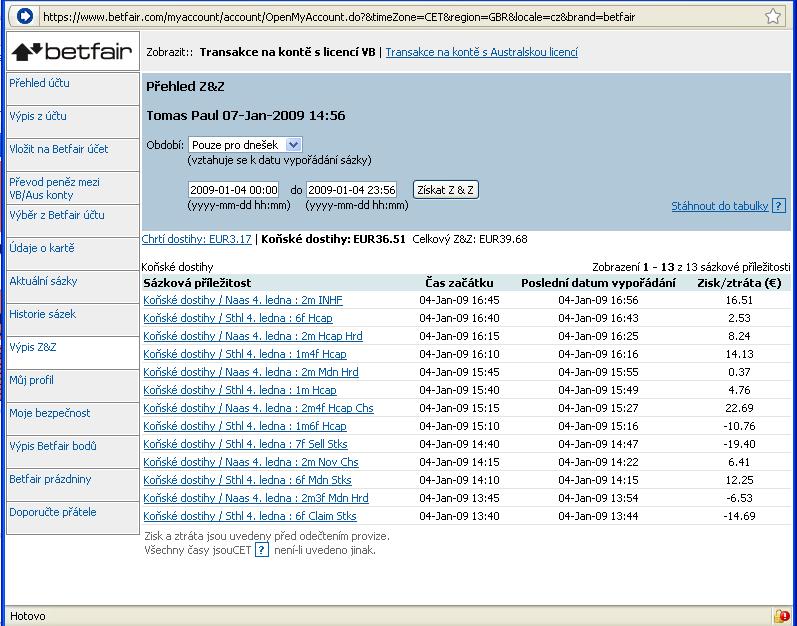

After this race I have stopped writing my feelings and I rather started to focus on trading. Yes, I had one loss after that, but then, I had an emotional autopilot in my head and I was focusing just on the markets. I have finished the day with a profit of 40€, here is the screen:

I was satisfied with that, because it was Sunday trading and two tracks were cancelled.

Emotions

I think it would be so long and boring to describe my whole day, but I just wanted to give you an idea that during the trading, you can feel a lot inside you. Someone who was very clever has invented a word for it – EMOTIONS. If you are able to control your emotions for three hours a day, you will have a wage like a president. Really, controlling your own emotions and a level of control is probably the only one big thing dividing successful traders from unsuccessful. I am not talking about situations when some elder man or woman wants to learn high frequency scalping, which might be a problem. As mentioned in many posts, the techniques for trading (using gaps, weight of money, work with support and resistance levels), are free and able. But nobody will guarantee how you will behave in the moment when market goes against you. One will stop the loss and will be OK, the second will leave the race in-play and his bank will go into the eternal hunting grounds…

In few last days, I have written a few notes and knowledge, which I want to talk about and say my humble opinion to them. It is not perfect, so I will be glad if you will write in the comments some concrete situation or a topic which can be discussed, too.

Losses

Losses are totally integral part of trading. The best trader in the world will have losses, so you will have them, too. If you do not have them, you are a God. If you are a God, I would like to meet you. Is it clear? You can’t stop having losses in your trading. It is the same as paying for food or for housing, it is just your expense in your business. Only one bad thing about losses – they can psychically affect you. Perfect situation is like this > accepting the loss > analyze the loss > and then going to the next race with completely calm mindset. To learn how to get your mind calm is very important. If you blame yourself for losing a few pounds, you can easily get into the situation when you will try to chase your loss. If you try to chase the loss, you will probably do it in the wrong way, because you will be focused in chasing the loss and you will not be focused to the situation in the market. Calm head and focus on the market are hugely important things in trading.

Loss analysis

What do I mean by this? For example my thoughts, which I had after that 19€ loss: “Minus 19€. Why? Because I did not follow the rules. Which rules? Entering the trade without signal and entering the trade because I was bored. Ok, I have broken my rules, so the loss is adequate for that. If I did not break them, I will probably be in profit. I will not break my rules.”

Analysis of your own losses is very important I think. But you have to be honest with yourself. Think if the loss was caused by breaking your rules (and which?) or just a very unexpected price change. I guarantee you that many losses are caused by breaking your rules. And rules are usually broken, when you are not focused, or if you want to chase the loss, etc. Really, your own irrational decisions are usually the biggest source of losses. And especially big losses. It is clear, that you will not be able to recognize where was the problem all the time and the loss can be incomprehensible for you. But trust me, everything can be done in better way, maybe you just do not know about the better way yet.

Of course there are losses which you can’t affect – for example if you are in an opened Lay position and then some huge Back bet arrives into the market 30 ticks below your price, you can’t do anything. But if you can’t do anything with that, the accepting of this loss should be much easier for you.

Losing day

Same as losses, you can have losing days, too. Again ask the question: am I God? If yes, I would like to meet you. If not, you will have losing days for sure. It’s good to analyze a losing day, too. Often it can happen that one big loss is responsible to your losing day. In one day, there are more markets you can trade, so it is less probable you will have a losing day than a losing race. Even less probable is a losing week, or month, God forbid a losing year or a losing life!

In my early days of trading, if I had two or three losing days in a row, I started to have bad thoughts in my mind: “Have I forgotten how to trade? Are there more better traders, who take my opportunities in the market?” These thoughts will never help you. Commodity trading has been there about 150 years or more and you can still see successful and unsuccessful traders there. Now, when I have these thoughts, I look to my stats spreadsheet. I can have losing day, two or three, but when I look at the spreadsheet, I immediately see there are minimum losing days. So I get my confidence back and my mind is in much better condition. And don’t forget – what’s in your mind is in your life.

Hint: after a losing day, do not forgive it. Do not be annoyed with yourself. Usually this day will be just your mistake, so replay that day your head, remember where you made mistakes and you will see that if you didn’t make those few mistakes, you would be in profit. Hopefully this idea will help you or will give you more confidence - that you know what to do & how to do it to be in profit. The question is – why don’t you do that?

First trades

First trades in the day can affect your behavior in the next races. If you make losses during first races, your confidence can go down and you can have tendency to be careful and scary. It is like putting opaque glasses to your eyes – you will not see the markets in the same way as with a calm mind. On the other hand, if your first trades are profitable, you can start have a feeling that you are invincible. By this behavior you will put X-ray glasses to your eyes and you will start see things in the market which don’t exist.

Hopefully you understand me. If you have a few hundreds of races traded, you will agree that a quick success gives you wings and failure breaks your legs. You should avoid both situations. You do not have to fly, you also don’t need to crawl on the ground. You just need both legs and you should walk always in a manner to arrive into the destination. Doesn’t matter how quickly. Just keep the standard.

Long term application

Find a long term advantage in the market and apply this edge in the long term and without changes.

Example: on the greyhounds wait for the situation when Weight of money is much bigger on Back side and those moneys are not spoof. Then enter the market, and exit with 3-4 ticks profit for example. If you will see reversing the trend, scratch immediately.

Now I have told you how to earn money. Just apply this in the long term, without emotions and you should be in a profit. Why do people do not do this? Because not everybody is able to wait for the right situation, decide if the money is spoof or take loss when needed. You should look on trading from a long term perspective – it doesn’t matter if you have a losing day when you have profitable week. Even losing week is not disaster if you have a profitable month, etc. Do not want to be always in profit, you are a human!

Do Not Be Greedy

Do not be greedy. Read how I was doing when I wanted to improve my result in last few seconds. I saw in my eyes lots of $$$, milion, two millions, quickly, but then arrrh – minus 19€.

This will be the usual result when you want more than you are ready to have. With a bank of 100€ it is very hard (almost impossible for me) to earn 150€ a day. Have your feet on the ground. If you want to improve something quickly and in the few last seconds, it usually goes wrong. It is like trading blind, without tactics and randomly. And you shouldn’t do that. I can say that being persistent and honest will pay off. It is also very hard to start earning big money when you are new to trading. It is much more probable that you will lose money at the beginning of your trading career.

My personal experience from the past: I was comfortable in earning on greyhound markets, and I wanted to start trading horses. The very first day was great thanks to my novice luck and I earned around 150€. I said to myself – great, if it will go like this, I will have very nice money. I could not wait for the next day. I lost that day 200€, and the third day I lost 100€.

If you are really greedy, you can probably end with a loss. So – don’t be.

The conclusion is that I was really greedy, I wanted to earn 4000€ a month but I was complete newbie in horse racing markets. So my mind was in a bad set up - when I did a bad trade, I was angry and swearing, then I did even worse trade and I was even more angry and swearing more, too. So I stopped trading horses for some time. I wanted to run, but I was not able to walk, yet.

Rushing = STUPIDITY. Or in other words – who wants much, ends with nothing.

Always try to do something

I have already mentioned this in today’s day description. Trading is all about waiting for opportunity. Maybe trading on greyhounds is more about action in general, but for example horse racing trading can be described like this: "wait, wait, wait, wait, wait, attention, wait, wait, attention, wait, attention – opportunity, Back, wait, wait, Lay, profit, wait, wait, wait, wait, attention, hedge, end of market." Sometimes you can have races where you make lot of trades, but usually doing nothing is much better than always trying to do something.

Hoping

… is probably the worst thing you can do. I mean - just hope and do nothing.

There is an example of possible thoughts that are in mind after entering the loss trade: “It must turn in my direction…yes, it will turn…I hope it will turn…” Inplay. “It must turn during the race”. Five minutes later: “Why do I have just 0.03€ on my account?”

I bet that almost everyone who tried to trade on any exchange has a similar experience. Usually this is the point where successful traders are separated from unsuccessful.

The hint is – do not hope, just accept the loss.

Everything has its end

You should remember that. I mean all those price movements, trends, and all situations in the market. If you successfully enter the trade, remember that the move will not be infinite.

I also mean being a long time in your position in a market. If there is great situation for a quick scalp and you place a bet which is not matched, it does not mean the bet will be in a good place in the market for the rest of eternity. Five seconds later, the situation can be opposite. I said that before – do not fall in love with your trades.

You should be able to enter & cancel your trades in cool blood. Other example: you enter a trade and the market moves in your direction. Do not expect to move it indefinitely. Run your profits but also define a point which is good enough to exit the trade.

It is all related to the fear and greed. If you want more and more, you can end in loss instead of profit.

Conclusion

Conquer your emotions, follow your rules, analyze losses, do not hope, don’t be greedy, understand trading like a long term activity and you should be in profit J few simple rules, but their application is very hard usually for most of people.